No interest receivable account is used when the note carries compound interest, because in that case the carrying amount of notes receivable is increased by debiting it, as seen above. Notes receivable are financial assets of a business which arise when other parties make a documented notes receivable meaning promise to pay a certain sum on demand or on a specific date. Notes receivable are different from accounts receivable because they are formally documented and signed by the promising party, known as the maker of the note, to the party who receives the payment, known as the payee.

When is Interest on a Note Receivable Paid?

That is to say, if the original holder is without further liability, then the asset is effectively transferred and its amount should be removed from the books. Now, assuming the same facts as in Example 2, suppose that the note is assigned originally on 30 June 2021. Suppose that the same note in Example 1 is discounted on 1 April 2022 instead of 15 May. This type of liability is not disclosed in the balance sheet but should be described in a footnote if it is material. For the purposes of accounting class, we will focus on Accounts Receivable transactions where an Accounts Receivable is turned into a Note Receivable.

- A contingent liability is a possible liability that may or may not occur depending on some future event.

- Or, we can combine this entry with the journal entry for the repayment of the note.

- Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

- Therefore, notes are considered negotiable instruments, like cheques and bank drafts.

- Sometimes accounts receivables are converted into notes receivables to allow the debtors to pay the balance.

What is the approximate value of your cash savings and other investments?

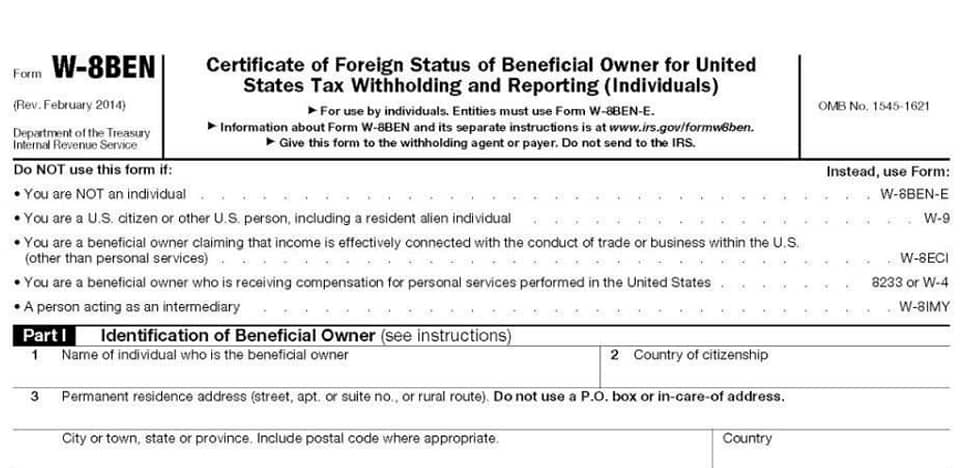

An asset representing the right to receive the principal amount contained in a written promissory note. Principal that is to be received within one year of the balance sheet date is reported as a current asset. Any portion of the notes receivable that is not due within one year of the balance sheet https://www.bookstime.com/articles/quickbooks date is reported as a long term asset. The supply store will record a journal entry of $25,000 in the debit column of the general ledger for notes receivable. At the same time, it will also enter a credit of the same amount for the original accounts receivable to cancel out that transaction.

- The payer, or the marker, is the borrower who gets the loan from the payee.

- MPC Co. sells goods to RSP for USD60,000 with payment due in 30 days.

- For example, assume that the Bullock Company has received a 3-month, 18% note for $5,000 dated 1 November 2019 in exchange for cash.

- Notes Receivable due in more than one year are listed in the Long-term Asset section of the Balance Sheet.

- The Interest Receivable amount of $124 is reducing the Interest Receivable account to show that the interest has been paid.

- To provide additional information, the debit could be recorded to an account entitled “Notes Receivable—Dishonored.”

Notes Receivable vs. Accounts Receivable

The accounting treatment of interest that is accrued but remains unpaid up to balance sheet date, depends on whether the interest is compound or simple. If it is a compound interest, the accrued interest that remains unpaid is added to the principal of note receivable and carried over to the next accounting period. Another opportunity for a company to issue a notes receivable is when one business tries to acquire another. Read this article on the terms of sale and the role of the notes receivable in the MMA/Hunt Acquisition to learn more. When interest is due at the end of the note (24 months), the company may record the collection of the loan principal and the accumulated interest.

Optimize working capital by driving world-class invoice-to-cash processes and leveraging decision intelligence to drive better business outcomes. Notes can be converted to cash by discounting them to the financial institutions. If the maker dishonors the note, the company discounting the note pays to the financial institutions. So far, our discussion of receivables has focused solely on accounts receivable. Companies, however, can expand their business models to include more than one type of receivable.

- If a customer approaches a lender, requesting $2,000, this amount is the principal.

- This record represents the complete settlement with cash upon maturity.

- When this occurs, the collection agency pays the company a fraction of the note’s value, and the company would write off any difference as a factoring (third-party debt collection) expense.

- The invoice is due in 60 days, which is the normal procedure for the supply store.

- Thus, Interest Revenue is increasing (credit) by $200, the remaining revenue earned but not yet recognized.